good natured Products Inc. Announces Year Ended December 31, 2021 Audited Financial Results

May 2, 2022 — (Vancouver, BC) good natured Products Inc. (the “Company” or “good natured®”) (TSX-V: GDNP), a North American leader in plant-based products, today announced its audited financial results for the three months (“Q4 2021”) and twelve months ended December 31, 2021 (“FY2021”). The Company also announced that it will host a webcast investor presentation on May 12, 2022 at 2:00 PM Eastern / 11:00 AM Pacific time.

FY2021 was another transformational year for the Company, with 266% revenue growth driven by contribution from strategic acquisitions and strong organic growth. Organic revenue growth was approximately 45%, up from 22% in the prior year, driven by a 300% increase in active B2B customer accounts. The Company also achieved its goal to improve adjusted EBITDA1 , and delivered positive adjusted EBITDA1 for the fourth quarter.

In addition to revenue growth through acquisitions, FY2021 results were achieved through the addition of a commercial agreement with a national U.S. food producer announced October 13, 2021, increases in average selling price per unit, along with the noted increase in B2B customers to over 1,200 active accounts at December 31, 2021 compared to 400 at December 31, 2020.

“Despite challenging macro economic conditions that required consistent and disciplined management of a changing business environment and global supply chain disruptions, good natured® again delivered record revenue performance in Q4 2021 and improved gross margins when compared to the third quarter,” stated Paul Antoniadis, CEO of good natured®. “We‘re off to a strong start in 2022, with our first quarter preliminary results indicating over 200% year-over-year revenue growth and gross margins near the high end of the targeted range. With robust end market demand driven in part by significant reshoring activity, combined with our investments in high-speed robotic machinery, I have never been more excited about what the future holds for good natured® and our owners!”

Key Highlights:

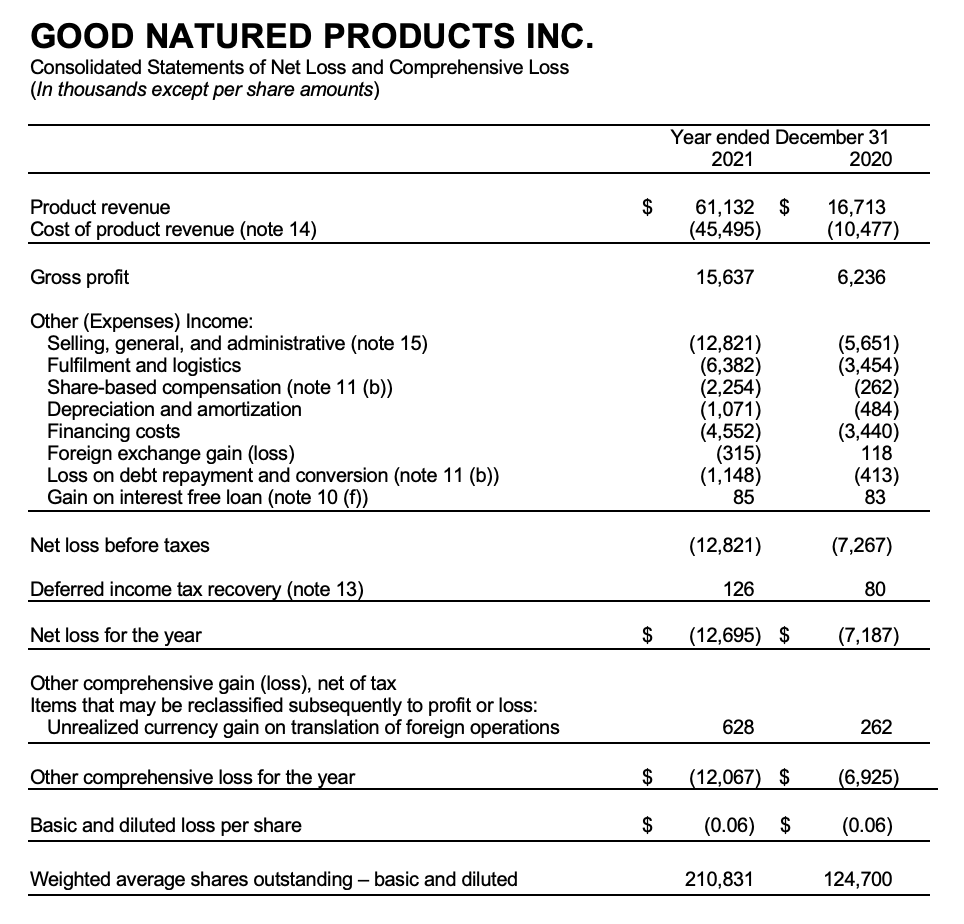

- Revenues for Q4 2021 increased 329% to a record $22.9 million compared to $5.3 million for the three months ended December 31, 2020 (“Q4 2020”). Revenue for FY2021 increased 266% to $61.1 million compared to $16.7 million for FY2020.

- Variable gross profit1 for Q4 2021 increased 262% to $7.0 million and 30.5% of sales, compared to $1.9 million and 36.2% of sales for Q4 2020. Variable gross profit1 for FY2021 increased 207% to $19.7 million and 32.2% of sales, compared to $6.4 million and 38.4% of sales for FY2020.

- Gross profit increased 205% to $5.3 million for Q4 2021 and 151% to $15.6 million for FY2021. Gross margin for Q4 2021 and FY2021 was 23.3% and 25.6% respectively.

- Selling, general and administrative (“SG&A”) expenses, excluding acquisition activity and one-time charges1, for Q4 2021 and FY2021 were $3.2 million and $10.2 million compared to $1.5 million and $4.3 million in Q4 2020 and FY2020. While these represented increases year-over-year, strong growth in revenue and gross profit more than offset SG&A expenses, producing positive operating leverage that resulted in the improvement in adjusted EBITDA1 noted above.

- SG&A expenses for Q4 2021 and FY2021, including acquisition activity and one-time charges, were $4.1 million and $12.8 million compared to $2.2 million and $5.7 million in Q4 2020 and FY2020, representing an increase of 88% and 127% respectively.

- The Company’s Adjusted EBITDA1 for Q4 2021 and FY2021 showed a gain of $0.5 million and a loss of $0.1 million, compared to a loss of $0.8 million and $1.5 million for Q4 2020 and FY2020 respectively.

- In Q4 2021, the Company incurred a net loss of $4.2 million compared to a net loss of $3.2 million in Q4 2020. Net loss for FY2021 was $12.7 million compared to a net loss of $7.2 million for FY2020.

- Net working capital increased to $20.6 million as at December 31, 2021, compared to $5.6 million at December 31, 2020, an increase of 271%.

The Company’s FY2021 audited financial statements and Management’s Discussion and Analysis are available on SEDAR at sedar.com and on the Company’s investor website at investor.goodnaturedproducts.com.

A non-GAAP financial measure. Please refer to “Non-GAAP financial measures” below for additional information.

Investor Webcast on May 12, 2022

The Company also announced that it will host an investor webcast on Thursday, May 12, 2022 at 2:00 PM Eastern / 11:00 AM Pacific time.

During the webcast, Paul Antoniadis, Chief Executive Officer of good natured®, will provide a presentation covering key areas of the business. After the formal presentation, attendees will have an opportunity to ask questions through an interactive Q&A portal.

To attend the webcast, please pre-register at the following link:

https://event.webcasts.com/starthere.jsp?ei=1540486&tp_key=2aeab4aeae

An archived version of the webcast and presentation will be available on the Company’s website at investor.goodnaturedproducts.com

The good natured® corporate profile can be found at: investor.goodnaturedproducts.com

About good natured Products Inc.

good natured® is passionately pursuing its goal of becoming North America’s leading earth-friendly product company by offering the broadest assortment of plant-based products made from rapidly renewable resources instead of fossil fuels. The Company is focused on making it easy and affordable for business owners and consumers to shift away from petroleum to better everyday products® that use more renewable materials, less fossil fuel, and no chemicals of concern.

good natured® offers over 400 products and services through wholesale, direct to business, and retail channels. From plant-based home organization products to certified compostable food containers, bio-based industrial supplies and medical packaging, the Company is focused on making plant-based products more readily accessible to people as a means to create meaningful environmental and social impact.

For more information: goodnaturedproducts.com

On behalf of the Company:

Paul Antoniadis – Executive Chair & CEO

Contact: 1-604-566-8466

Investor Contact:

Spencer Churchill

Investor Relations

1-877-286-0617 ext. 113

invest@goodnaturedproducts.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibilities for the adequacy or accuracy of this release.

Non-GAAP Financial Measures

We have included in this press release a discussion of the Company’s variable gross margin, SG&A excluding acquisition activity and one-time charges, and adjusted EBITDA, all non-GAAP measures, for Q4 2021, FY2021, Q4 2020 and FY2020 to provide, what management believes, is a meaningful comparison of the Company’s performance in Q4 2021 and FY2021. In this news release, variable gross margin is gross margin excluding fixed production costs such as depreciation, repairs and maintenance, utilities and similar overhead items, SG&A excluding acquisition activity and one-time charges is SG&A expenses but excluding acquisition costs and certain one-time charges and adjusted EBITDA is earnings before interest and finance costs, taxes, depreciation and amortization, other non-cash items and one-time gains and losses. Variable gross margin, SG&A excluding acquisition activity and one-time charges and Adjusted EBITDA do not have standardized meanings, and therefore may not be comparable to similar measures presented by other issuers. The use of variable gross margin by management allows for evaluation of the core aspects of the Company’s profit margin as certain fixed items, such as depreciation, repairs and maintenance, and utilities are excluded. The use of SG&A excluding acquisition activity and one-time charges allows for an evaluation of Company’s expenses disregarding the expenses associated with the Company’s voluntary execution of Its growth through acquisition strategy. The use of the adjusted EBITDA by management allows for evaluation of the Company’s principal business activities as certain non-core items such as interest and finance costs, taxes, depreciation and amortization, and other non-cash items and one-time gains and losses are removed.

The following table provides a reconciliation of net loss to adjusted EBITDA for the periods ended:

The following table provides a reconciliation of gross margin to variable gross margin for the periods ended:

The following table provides a reconciliation of selling, general and administrative expense excluding acquisition activity and one-time charges:

Preliminary Results

The preliminary results set forth above are made as of the date of this news release and are based on an initial review of the Company’s operating and financial results for the quarter ended March 31, 2022 and are subject to change. These preliminary results are provided for the purpose of providing the readers with further context to the Company’s FY2021 results. Final reported results could differ from these preliminary results following the completion of quarter-end accounting procedures, final adjustments and other developments arising between now and the time that the Company’s financial results are finalized, and such changes could be material. The Company’s independent auditor, Deloitte LLP, has not audited, reviewed or performed any procedures with respect to the accompanying preliminary financial results and other data, and accordingly does not express an opinion or any other form of assurance with respect thereto. The preliminary results have been prepared by, and are the responsibility of, the Company’s management, and were approved by management on April 18, 2022. In addition, these preliminary results are not a comprehensive statement of the Company’s financial results for the quarter ended March 31, 2022. They should not be viewed as a substitute for audited financial statements prepared in accordance with International Financial Reporting Standards and are not necessarily indicative of the Company’s results for any future period.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of securities laws including statements related to Company plans and focuses for 2022, anticipated financial results for the quarter ended March 31, 2022, the upcoming results conference call and management’s outlook for 2022. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

When relying on the Company’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company has assumed that the material factors referred to herein will not cause such forward-looking statements and information to differ materially from actual results or events. However, there can be no assurance that such assumptions will reflect the actual outcome of such items or factors.

Other than as required under securities laws, we do not undertake to update this information at any particular time.

Forward-looking information contained in this news release is based on our current estimates, expectations and projections regarding, among other things, sales volume and pricing which we believe are reasonable as of the current date. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. All forward-looking information contained in this news release is expressly qualified in its entirety by this cautionary statement.